Strategic planning

&

Funding

People are receiving large amounts of funding every single day. Your vision can become a reality with the right road map in place.

We have methods for obtaining funds in very short order but are more satisfied working through complex projects and helping client’s find real solutions. Rates are determined by the financing route taken and the credentials of the client.

Get Pre-Qualified

Stop running up hard inquiries on your credit report by applying with every company

you can find. Apply where you know you will be approved!

Business Loans

There are paths to funding for startup businesses and many more options for those that have been in existence for a few years. Let us know your plan and we will help you find the right fit.

Personal Loans

A lot of entrepreneur’s are more concerned about getting started than they are about where the money comes from. Use your personal credentials to get what you need.

Strategic Planning

Rates are important and so is the scalability of your business. You may not qualify for what you desire today, but we can help you design a road map to get there.

The Power of Business

Make an impact on your community.

Let's Get You Funded!

We keep it easy because it is the only way it should be.

Frequently Asked Questions

Here are common questions that we are asked. Please feel welcome to reach out if you have specific questions or comments. We will respond as soon as possible.

Do you charge upfront fees?

We do not charge any upfront fees for the majority of loans that we help you acquire. There is one circumstance with vendor financing that will require an upfront fee. There are sometimes fees, outside of our control, depending on a couple scenarios. If you do not qualify today, we will refer you to the sources that can repair what is needed to get you qualified in the near future. Real Estate transactions can sometimes call for appraisals upfront which is also outside of our control. We work to avoid all upfront fees whenever possible.

What are the rates?

Rates on loans can fluctuate anywhere from 0% to as high as 40%. We work to position you to qualify for the best possible rates that you are able. We do this by assuming the best lending tactic to suite your need. We also try to avoid “Merchant Cash Advance” loans whenever possible. There are scenarios when this can make sense to an owner and it is always up to the client to decide to accept the offer or not.

Does 100% financing exist?

The short answer is, YES! However, this generally calls for the combination of a couple of different types of loans to accomplish the goal. It is possible in a lot of scenarios with the right credentials.

What are the credit requirements?

Having good credit gives you more options and better rates, but there are methods that can be used to obtain funds even with poor credit. We are happy to let you know specific guidelines as we understand your objectives.

What if I've been declined?

People get declined all the time and it generally means the guidelines were not understood before an application. This is not a reason to give up on your dream. We can help you map out a plan to position yourself to get approved.

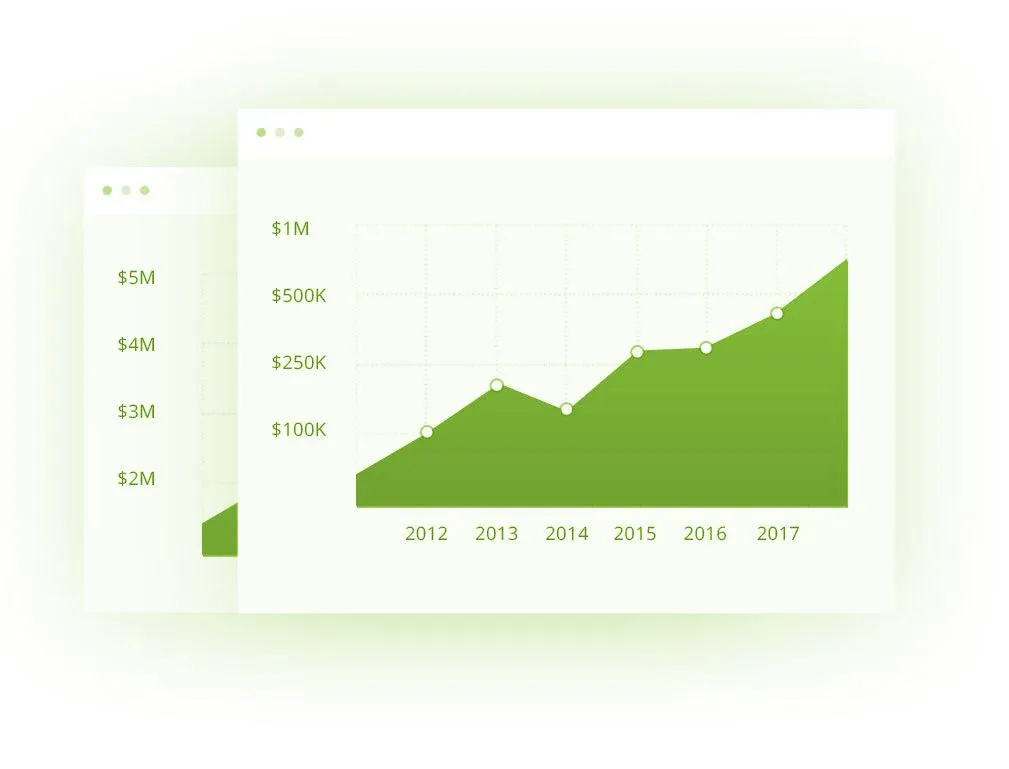

How much funding can you obtain?

Limitations are set by you and your project. In general, startup businesses can obtain up to $500,000 and existing have the opportunity for even more. When you consider real estate transactions and collateral, the loan size can easily extend into the tens of millions. There is no deal too large for us to work on.

How do I start with you?

The first step in our process is to review your qualifications and objectives to understand the best options for you. We do not charge a fee for this advice. The only thing you need to do is click on the “Get Started” tab and fill in the form. One of our consultants will be back in touch to walk you through the rest.

How long are the terms?

The terms on any loan sought will be clarified before a real application. Some loans a structured to be extremely short term, like 3 months, while others extend for up to 30 years.

What if I don't qualify today?

Sometimes it does take a little time to position yourself to get what you need. The good news is that we can explain exactly what needs to be done and it won’t cost you a penny for the advice. Then, when you are ready in the near future, we can get you the money you seek.

What if I have a quote?

If another company has provided you with a quote for the loan you seek, let us know. We are happy to help you shop rates and compete to make sure you are getting the best deal.

What is a soft pull?

A soft pull allows us the ability to review what is on your credit report without having it impact you negatively. When you apply for a loan a hard inquiry is done and too many inquiries can lead to denials.

How is my loan status tracked?

We will be providing a client portal where you will be able to sign in and see any updates in real time as we work on your project.

Contact Us

(877) 356-8006

440 Monticello Ave Ste 1800, Norfolk, VA, 23510